14 Ayar Altın Bileklik Modelleri ile altının zarafetini şıklığınıza yansıtın. www.gencay.com' da sevgiliye hediyeler.

22 Ayar Altın Bileklik Modelleri ile altının zarafetini şıklığınıza yansıtın. www.gencay.com' da sevgiliye hediyeler.

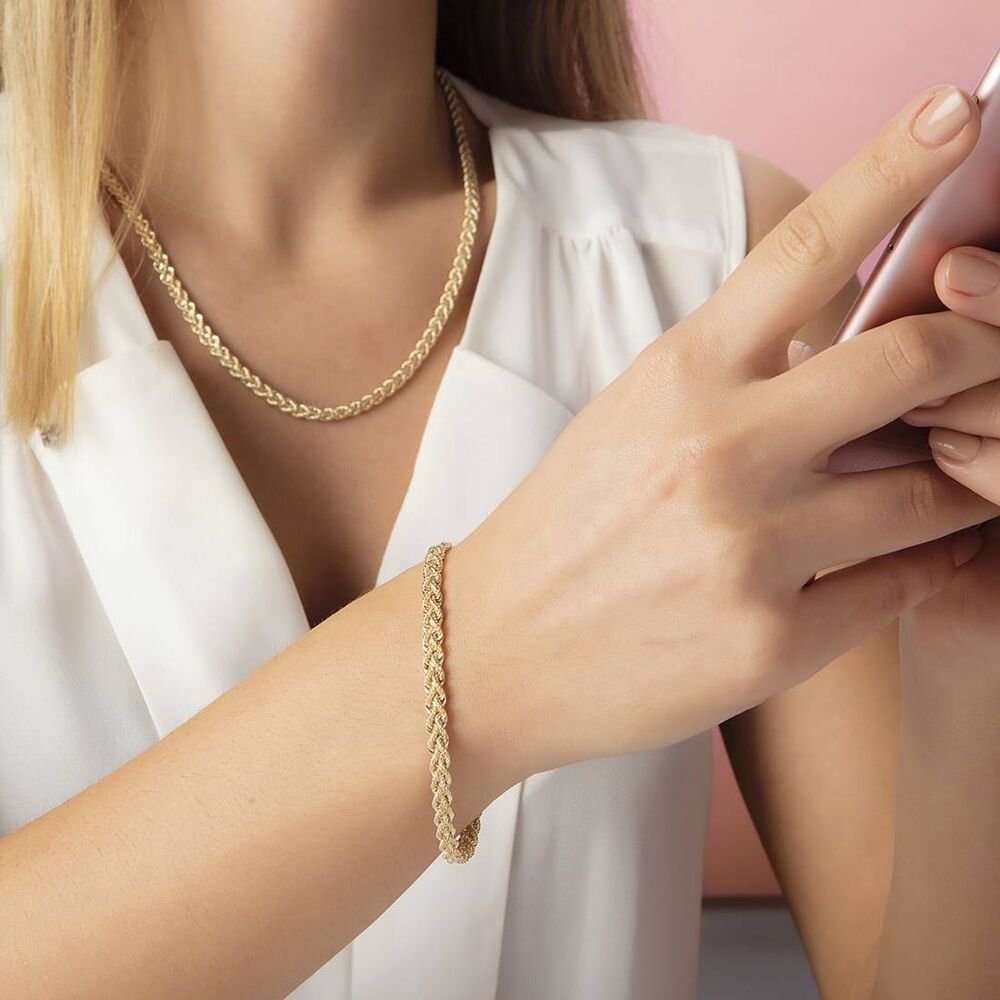

Prenses Pırlanta-Kadın 22 Ayar Çeyrek Altın Altın Kolye Modeli ve Altın Bileklik Modeli Set - Prenses Pırlanta

Çeyrek Altın Bileklik Modelleri.. #kuyumcu #kuyumculuk #çeyreklibileklik #çeyrekaltın #altınzincir #altınkolye #moda #altınbilekl... | Instagram