Franke Mythos Siyah 75 Cm Gazlı Ocak + 90 Cm Maris Davlumbaz Ankastre Seti - 90 Cm Gazlı Maris Myhtos Set

Franke Smart Linear 90 Cm Ankastre Ocak - Franke - ANKASTRE OCAK Franke New Glass Linear Ankastre Ocak

Franke Trendline 5 Göz İnox Ankastre Ocak - Franke - ANKASTRE OCAK Franke Trendline 5 Göz Ankastre Ocak

Franke İnox 4'lü Ankastre Set - Franke - ANKASTRE SET Franke İnox 3 lü Ankastre Set + Bulaşık Makinesi

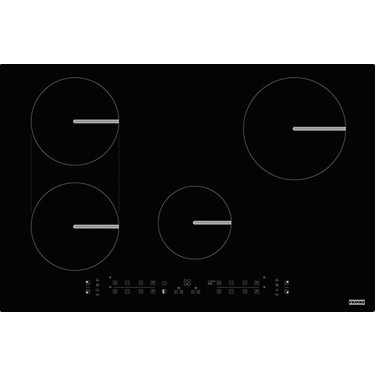

Franke FSM 654 I B BK İndüksiyonlu Siyah Ankastre Ocak Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

Franke Classıc Line Rustik Ankastre Set (FCO 86 H Fırın FCH 755 4G TC PW C Ocak FCO 70 PW Davlumbaz Fiyatı, Yorumları - Trendyol

Franke FRSM 604 C T BK Siyah Cam Seramik Elektrikli Ankastre Ocak Blanco, Teka, Franke Ankastre Set ve Cihazları, Eviye Fiyatları ve Modelleri | Kuvantum Online

Franke Maris FHMA 755 4G DCL OY C Oyster 5 Gözlü 75 Cm Paslanmaz Çelik Ankastre Ocak - 106.0572.276 - 106.0572.276

Franke Franke Ankastre Set (fhns 604 4g Bk C Ocak - Fsl 86 H Bk Fırın - Fpj 615 V Bk A Davlumbaz) | Ankastre Setler