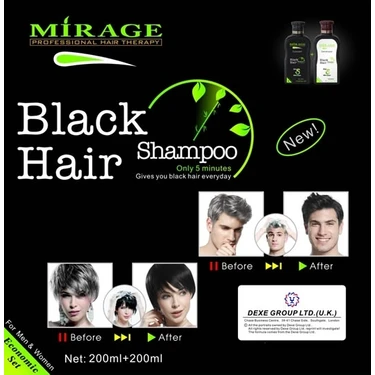

Botanik Ecza - 444 4 996 в Instagram: "Mirage Şampuan ve Saç Dolgunlaştırıcı Toz Ürünlerinde 3 Al 2 Öde Fırsatı Sizlerle! Mirage Black Hair Saç Beyazlarını Kapatıcı Şampuan ile siz de beyaz

Amazon.com : Compagnia Del Colore 001 Mirage Shampoo 33.8 Oz, 002 Mirage Mask 13.52 Oz and 003 Mirage Oil 3.38 Oz "Free Starry Sexy Kiss Lip Plumping 10 Ml" : Beauty & Personal Care

Mirage Şampuan Beyazlayan Saçlara Özel Saç Rengi Yenilemeye Yardımcı Bakım Kürü - 68,99 TL'ye Sipariş

Mirage Black Hair Saç Beyazlarını Kapatıcı Şampuan sizlerle. Ürün uygulama sırasında hedef siyah saç rengi elde etmek olsada ... | Instagram