Sesu Normal Ciltler Ayçiçekli 24'lü Sir Ağda Bandı Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

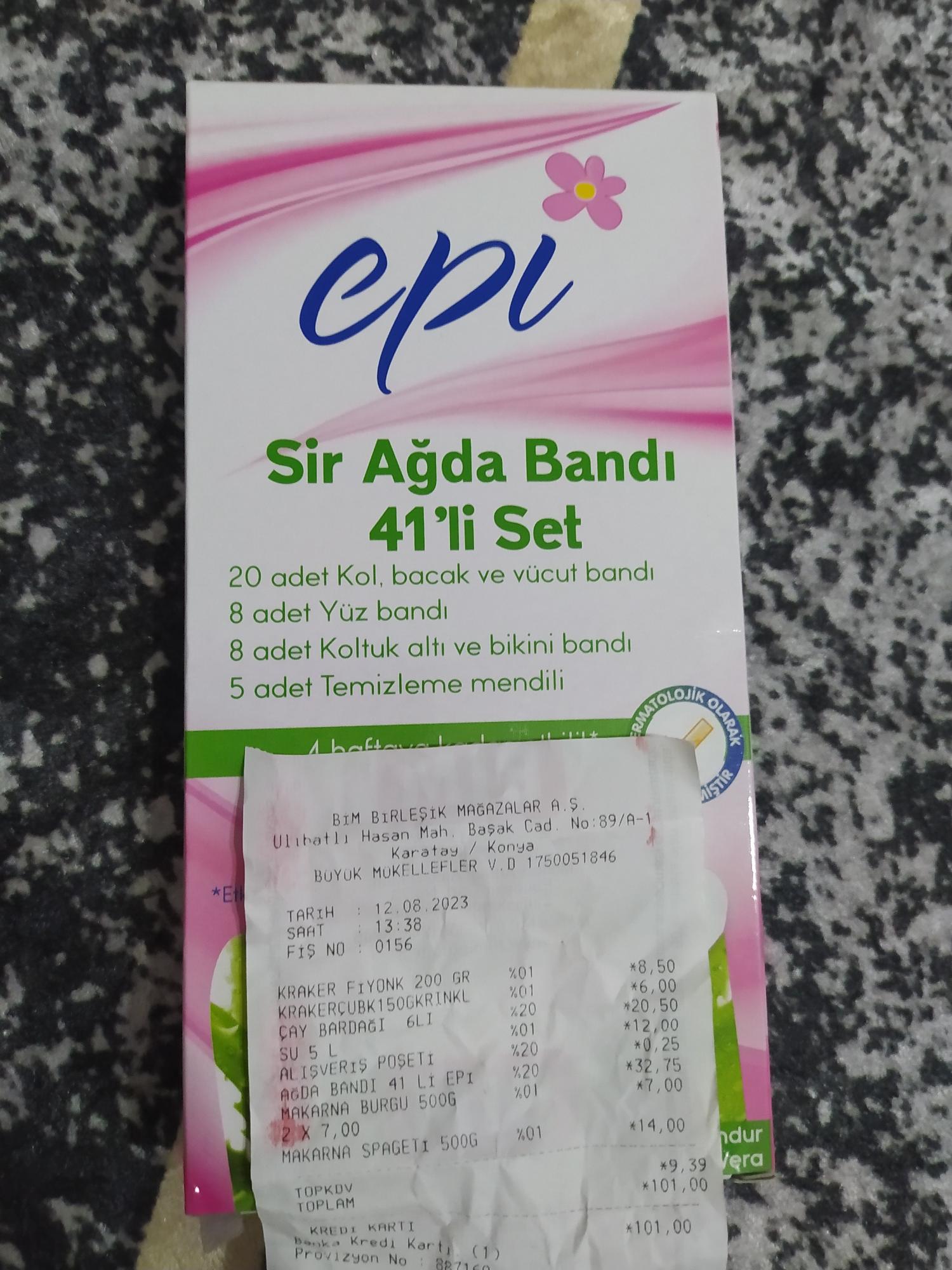

Bim Ağda Ve Sir Ağda Bandı Fiyatları 2024 - Aktüel Bim ve A101 Marketlerinin En Yeni Aktüel Katalogları

Veet Hassas Ciltler Bacak & Vücut Bölgesi 20'li Sir Ağda Bandı Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe