Pelo Trimmer Clippers Pelo De La Barba Trimmer El Peine Para Philips QC5130 / 05/15/20/25/35 3-21mm : Amazon.es: Belleza

YanBan Peine de repuesto para cortadora de cabello para Philips QC5105 QC5115 QC5120 QC5125 QC5130 QC5135 pequeño (3-21mm) : Amazon.es: Belleza

Cortapelos negro para afeitadora de barba, accesorio de peine para Philips QC5130, QC5105, QC5115, QC5120, QC5125, QC5135, 1 unidad - AliExpress

Cortapelos eléctrico de repuesto, accesorio para afeitadora de barba, regalo para Philips QC5130 QC5105 QC5115 QC5120 QC5125 QC5135 - AliExpress

Cortadora de pelo para philips, peine de 1-21MM, QC5105, QC5115, QC5120, QC5125, QC5130, QC5135 - AliExpress

Peine para el cabello Bebetter 3pcs para Philips Qc5130 Qc5105 Qc5115 Qc5120 Qc5125 Qc5135-subaoe | Fruugo ES

Cortapelos para Philips QC5130/05/15/20/25/35, peine recortador de barba, accesorio de 3-21mm, gran oferta

Cortapelos negro para afeitadora de barba, accesorio de peine para Philips QC5130, QC5105, QC5115, QC5120, QC5125, QC5135, 1 piezas - AliExpress

Pelo Trimmer Clippers Pelo De La Barba Trimmer El Peine Para Philips QC5130 / 05/15/20/25/35 3-21mm : Amazon.es: Belleza

Cortapelos eléctrico de repuesto para afeitadora de barba, accesorio de peine, regalo para Philips QC5130, QC5105, QC5115, QC5120, QC5125, QC5135 - AliExpress

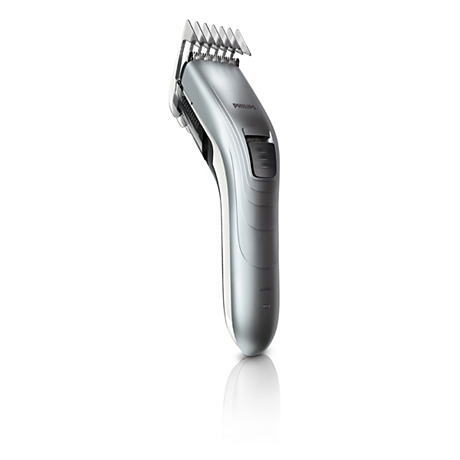

Philips QC5130/QC5131 Electric Hair Clipper Shaver Household Adult / Children Electric Hair Clipper Hair Salon Special Electric Hair Clipper Shaver rechargeable | Shopee Malaysia

Cortadora de pelo para philips, peine de 1-21MM, QC5105, QC5115, QC5120, QC5125, QC5130, QC5135 - AliExpress