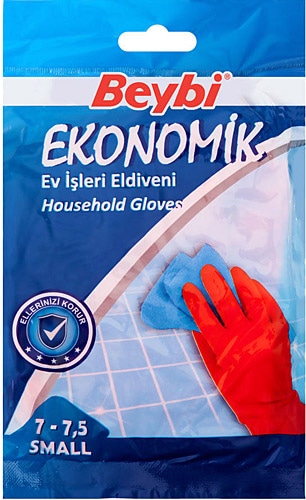

Beybi Ekonomik Small 7 - 7.5 Beden Bulaşık Eldiveni Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

ACR Sihirli Silikon 2 li Bulaşık Eldiveni Çok Amaçlı Gri - Yeni Ürünler - ACR Sihirli Silikon 2 li Bulaşık Eldiveni Çok Amaçlı - Doğudeko Store - Online Alışveriş